E-commerce platform Shopify rose 1% Friday morning, and Ascent Wealth Partners' Todd Gordon is eyeing a key level in the stock.

Just Thursday, Shopify dropped as much as 13% after it suspended its full year 2020 guidance on uncertainty disruptions from the coronavirus outbreak. Even so, the stock is still outperforming the broader market, down about 13% year to date while the S&P 500 has tanked 22%.

And here's another article:

Analysts' Top Technology Picks: Box (BOX), Shopify (SHOP)

There’s a lot to be optimistic about in the Technology sector as 2 analysts just weighed in on Box ( BOX ) and Shopify ( SHOP ) with bullish sentiments.

* * *

Oppenheimer analyst Ittai Kidron maintained a Buy rating on Box today and set a price target of $16.00 . The company’s shares closed last Thursday at $14.71.

According to TipRanks.com , Kidron is a top 25 analyst with an average return of 28.4% and a 68.4% success rate. Kidron covers the Technology sector, focusing on stocks such as Zoom Video Communications, Slack Technologies, and Cambium Networks.

Will Shopify lead the way? | Morningstar

Andrew Willis: Shopify ( SHOP ) has stood like a beacon of hope in a sea of red a few days last week. Anyone following our Twitter posts may have seen the company, boasting big green gains, while other names around them floundered.

So why does Shopify stand with gold stocks amidst all of the market uncertainty? Because the trend is still there. E-commerce certainly got a bump from investor attention throughout the coronavirus crisis. But the question is: is this the start, or end of the trend for Shopify?

Roth Capital Reiterates a Hold Rating on Shopify (SHOP)

In a report released today, Darren Aftahi from Roth Capital reiterated a Hold rating on Shopify ( SHOP ), with a price target of $320.00 . The company’s shares closed last Thursday at $347.28.

According to TipRanks.com , Aftahi is a 5-star analyst with an average return of 9.1% and a 48.1% success rate. Aftahi covers the Technology sector, focusing on stocks such as Digital Turbine, The Meet Group, and Mitek Systems.

In case you are keeping track:

Shopify has price target cut at National Bank - Cantech Letter

Shares of Shopify ( Shopify Stock Quote, Chart, News TSX:SHOP ) have been falling sharply the last two trading days after the e-commerce company suspended its 2020 guidance on account of the COVID-19 pandemic.

But investors should look beyond the present calamity and see Shopify for the disruptive force it is in the growing e-commerce movement, said National Bank Financial's Richard Tse, who issued an update on the company on Tuesday.

Shopify helps retailers socially distance | Chain Store Age

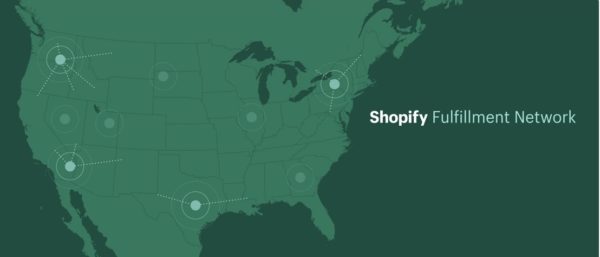

A leading digital commerce platform is running several initiatives aimed at helping retailers adapt to new shopping protocols in the wake of COVID-19.

Shopify is making local in-store /curbside pickup and delivery available for all retailers using its POS platform. In addition, the company is making gift cards available on all plans and for all retailers.

Shopify is also offering an extended 90-day free trial to all new standard plan signups, and committing $200 million for its Shopify Capital funding arm while fast-tracking expansion to core geographies working with partners and governments, including in the U.K., where Shopify Capital launched on March 30, 2020.

Walgreens, Shopify fall; Occidental, Nevro rise

The pharmacy chain warned investors that it can’t accurately assess the virus pandemic’s impact on its finances.

* * *

The used car dealership warned investors about a significant drop in sales as the virus pandemic shuts its operations.

The clothing and apparel retailer is closing all its stores for two weeks and withdrawing its financial forecasts.

The e-commerce company suspended its financial forecasts for the year because of uncertainty over the virus pandemic’s impact.

Shopify (NYSE:SHOP) - Why Shopify's Stock Is Trading Lower Today | Benzinga

Shopify (NYSE: SHOP ) shares are trading lower on Thursday, after the company withdrew its fiscal year 2020 guidance.

* * *

Shopify is a Canadian multinational e-commerce company headquartered in Ottawa, Ontario. It is also the name of its proprietary E-Commerce platform for online stores and retail point-of-sale systems.

Shopify's stock was trading down 11.36% at $340 per share at time of publication. The stock has a 52-week range between $593.89 and $190.38.

Happening on Twitter

This is the most important level to watch in Shopify shares, trader says $SHOP (via @TradingNation) https://t.co/qZrNwdGbvS CNBC (from Englewood Cliffs, NJ) Fri Apr 03 15:52:03 +0000 2020

No comments:

Post a Comment