Big sales, big crowds, big profits—holiday shopping is big business. Many stores typically depend on strong sales in Q4 to hit their annual goals and put them on a path towards future growth.

But like nearly everything else in 2020, holiday shopping this year will be anything by typical.

Fueled by changes in customer preferences and economic situations, as well as a global pandemic, holiday shopping will be quite different this year. Retailers need to make adjustments to best serve their customers and find success.

Were you following this:

Your grocery shopping cart now has assistance with these time-saving, detachable bags [Video]

Grocery shopping can be an annoying errand to run, but these shopping bags can help make that task a breeze. The Lotus Trolley Bag turns your shopping cart into your personal assistant. It saves money, time and energy all while saving the planet from having to use plastic bags.

Sam's Club Lets Customers Do Their Holiday Shopping in the Iconic Griswold Family Home

The pandemic has left consumers on a tight budget and much less likely to head to brick-and-mortar locations to purchase gifts. At the same time, shoppers are missing the joys of in-store shopping, with 71% missing discovery and casual browsing, and 73% missing tactile experiences.

This means brands must craft creative online shopping experiences and alternate pick-up and delivery options that will appeal to and actively engage shoppers. In creating an interactive environment that allows shoppers to experience the joys of shopping, Sam's Club has demonstrated a heightened understanding of the desires of this year's consumers.

Why People Prefer Outlet Malls Over Other Shopping Centers Amid COVID – Footwear News

In the era of COVID-19, as people and whole economies crumble under the weight of its ripple effects , no person or company is truly winning.

However, a new report from Placer.ai indicates that when it comes to shopping centers, not all such spaces are feeling the negative impact of the health crisis to the same degree.

A new report from market research firm Placer.ai found that outlet malls are recovering at a much faster rate than their peers: Year over year weekly data for Sept. 28 shows visits to outdoor malls were down 23.6% while indoor centers declined 33.2%. At outlet malls, however, average traffic for that same week was down just 9.3% — an indication that such centers are closing in on their prior year’s levels.

While you're here, how about this:

Walmart extends shopping hours starting Nov. 14 - MarketWatch

Walmart Inc. WMT, -1.17% will be open from 7 a.m. to 11 p.m., extending its shopping hours from a previous closing time of 10 p.m., starting Nov. 14. "This will give customers more time to shop and help us disperse traffic throughout the day. Stores with more reduced hours will keep current hours of operation," the retailer said in a tweet . Walmart will continue to offer a special hourlong shopping window for customers ages 60 and over before the official 7 a.m. opening time.

Google to Highlight Best Shopping Deals in Search Results

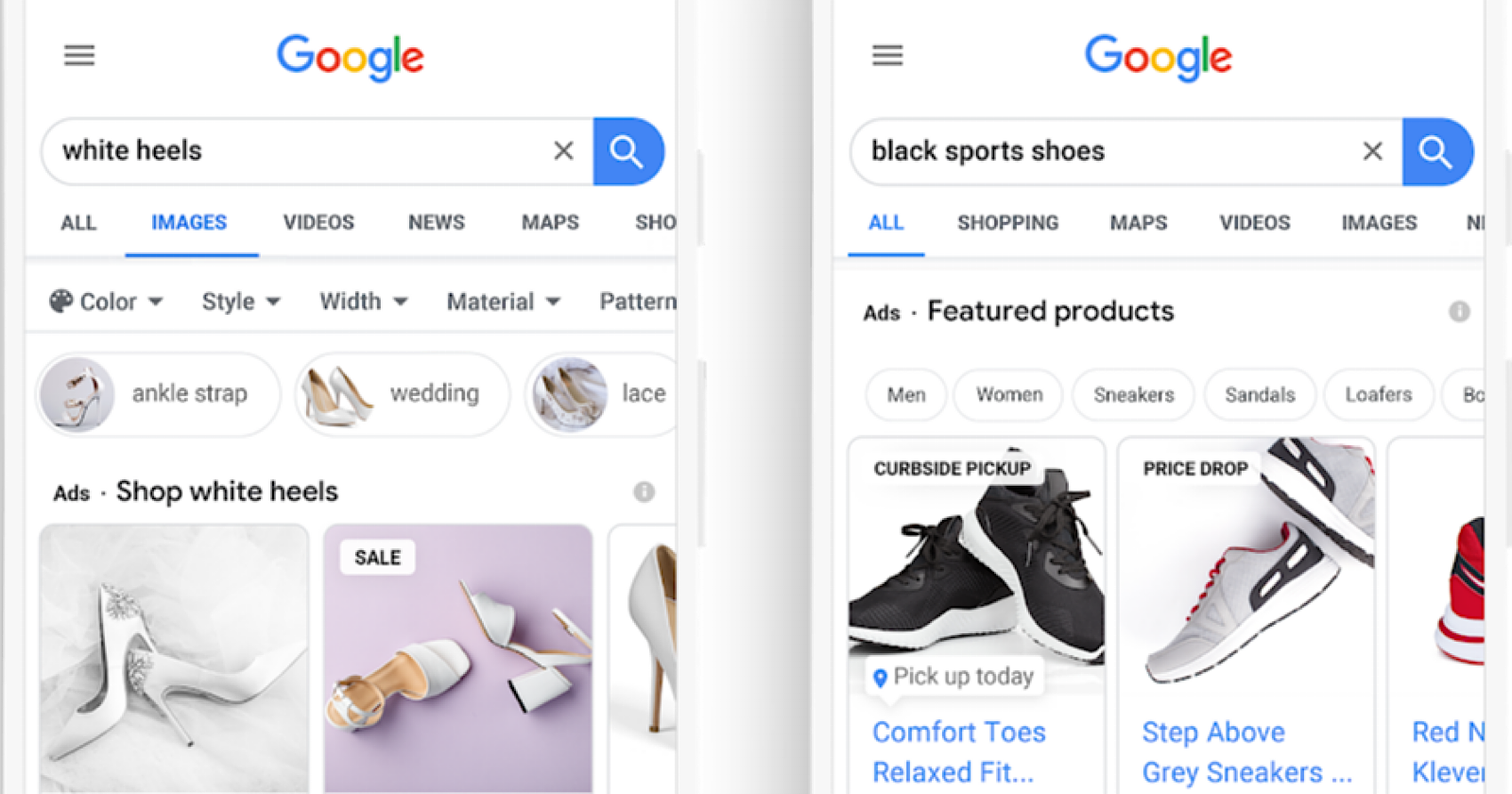

Google is highlighting top shopping deals in search results in an effort to boost visibility for retailers while ensuring shoppers get the best available prices.

In a series of related updates, Google is making it easier and faster to apply product promotions, attract new customers, and uncover meaningful insights.

And yes, these updates all apply the free shopping listings Google began offering earlier this year.

Google Invests in an Online Shopping Platform - Search Engine Journal

It’s being reported that Google and another company have agreed to invest $350 million dollars in a popular Indonesian online shopping platform named Tokopedia. Tokopedia is a major online marketplace in Indonesia that is reported to contribute over 1% of Indonesia’s economic growth.

Google did not purchase the shopping platform, it’s just an investment that adds to the billions of dollars already invested by SoftBank and Alibaba.

Jill On Money: The virtual holiday shopping season has begun

Well before Halloween, the virtual holiday season has begun. Amid controversy (including the House Judiciary Committee’s Antitrust Subcommittee more than 400 page report) surrounding its dominance, Amazon kicked off the festivities with Prime Day on October 13 and 14, a three-month delay from the usual July event). Amazon has become such a

behemoth among shoppers (the company accounts for 39% of total US e-commerce sales) that the October event “could potentially steal up to 10% of Cyber Week’s digital revenue,” according to analysis from Salesforce.

Happening on Twitter

Here are 5 ways holiday shopping will be different in 2020: https://t.co/zT2f30m0iy https://t.co/lonXVw2uiw Forbes (from New York, NY) Mon Oct 26 14:13:36 +0000 2020

No comments:

Post a Comment