Our mission is to make commerce better for everyone and to do that, we spend a lot of our time thinking about how to make commerce better in parts of the world where money and banking could be far better . . . As a member of the Libra Association, we will work collectively to build a payment network that makes money easier to access and supports merchants and consumers everywhere . . .

* * *

As part of the Libra Association, Shopify will become a validator node operator, gain one vote on the Libra Association council and can earn dividends from interest earned on the Libra reserve in proportion to its investment, which is $10 million at a minimum.

Quite a lot has been going on:

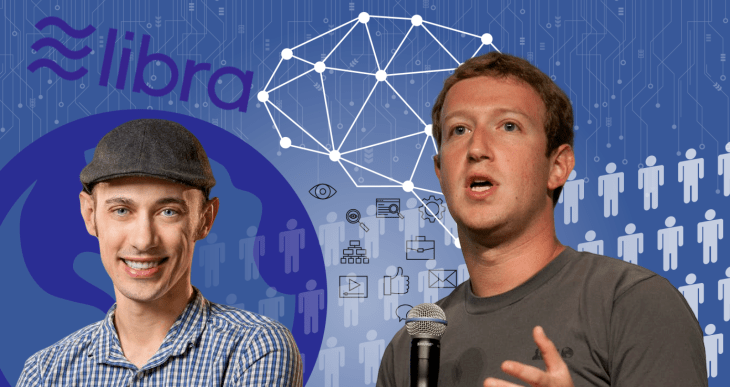

Shopify signs on to Facebook-led Libra Association - The Logic

The Ottawa-based e-commerce company joins 16 other corporate members—which are required to contribute US$10 million each to the project—and four non-profit partners working on the development of a global digital cryptocurrency, which is meant to make payments and money transfers easier, particularly in countries that don't have well-developed systems for them. Shopify did not immediately respond to a request for comment. (The Logic)

Banco Santander S.A. Sells 168 Shares of Shopify Inc (NYSE:SHOP) - Enterprise Echo

Banco Santander S.A. decreased its position in Shopify Inc (NYSE:SHOP) (TSE:SHOP) by 15.7% during the 4th quarter, according to the company in its most recent filing with the SEC. The fund owned 903 shares of the software maker’s stock after selling 168 shares during the quarter. Banco Santander S.A.’s holdings in Shopify were worth $359,000 at the end of the most recent reporting period.

Several other institutional investors and hedge funds have also recently bought and sold shares of SHOP. Pacifica Partners Inc. acquired a new position in Shopify during the 4th quarter worth about $29,000. Sugarloaf Wealth Management LLC acquired a new position in Shopify during the 4th quarter worth about $34,000. Gs Investments Inc. lifted its position in Shopify by 178.6% during the 3rd quarter. Gs Investments Inc.

Register to read | Financial Times

Many things are taking place:

CANADA STOCKS-TSX hits record high on oil rally, Shopify surge - Reuters

Feb 12 (Reuters) - Canada’s main stock index hit a new high at open on Wednesday, driven by energy stocks as oil prices rallied on optimism over fewer new coronavirus cases, while Shopify shot up nearly 20% after upbeat quarterly earnings.

* At 09:30 a.m. ET (14:30 GMT), the Toronto Stock Exchange’s S&P/TSX composite index was up 90.14 points, or 0.51%, at 17,867.25. (Reporting by Susan Mathew in Bengaluru;)

Why Shopify Is Set to Smash Quarterly Earnings Expectations | Nasdaq

Investors who demand value may take a quick “pass†on Shopify (NYSE:) by looking at its price-to-earnings ratio near 2,000 times . Yet momentum and growth investors may point to its exceptionally strong historical and future growth rates.

* * *

So, how much more upside does Shopify bring to shareholders, now that the stock closes at 52-week highs almost daily?

Shopify, Teva rise; Western Union, Lyft fall

The ride-hailing service disappointed investors by sticking to its long-term forecast for profitability by the end of 2021.

* * *

The e-commerce company reported a surge in revenue that helped it blow away Wall Street’s fourth-quarter earnings forecasts.

The owner of Calvin Klein and other brands reaffirmed its profit forecast for the year, despite the new coronavirus’ impact on sales.

The advertising and marketing services company’s fourth-quarter profit and revenue beat Wall Street expectations.

Happening on Twitter

Shopify spends a lot of time thinking about how to make commerce better in parts of the world where money and banki… https://t.co/ucE1iYOVLJ tobi (from Canada) Fri Feb 21 15:24:13 +0000 2020

We are excited to welcome @Shopify to the Libra Association! As a commerce platform helping launch & grow 1 million… https://t.co/61V5AIGMry Libra_ Fri Feb 21 15:24:01 +0000 2020

BREAKING: @Shopify is joining the @Libra_ Association, it announced Friday. https://t.co/Wue2OVaNpe @nikhileshde reports coindesk (from New York, USA) Fri Feb 21 15:16:48 +0000 2020

No comments:

Post a Comment